BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

The Future of Banking: AI-First Banks with Multi-Agentic AI

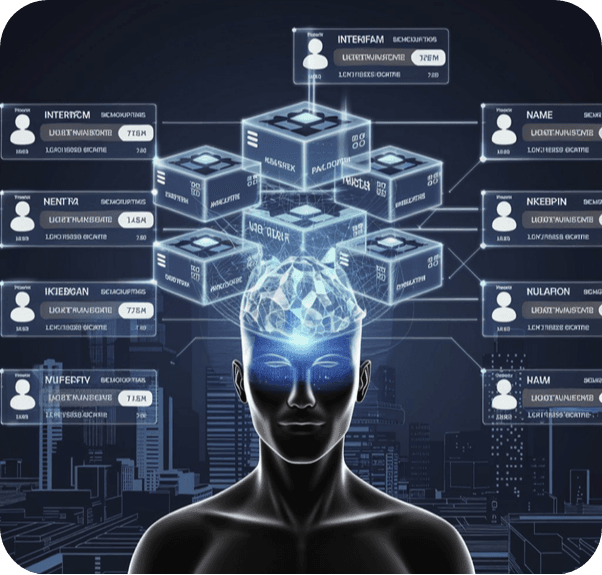

The banking industry is undergoing a technological transformation, driven by the rapid advancements in Artificial Intelligence (AI). One of the most significant shifts on the horizon is the rise of AI-based banks powered by multi-agentic AI systems. In these banks, AI is not just a tool for automation, but a fundamental component embedded deeply into every facet of banking, from decision-making to customer interactions. With multi-agent systems, a network of specialized AI agents work in tandem, collaborating and communicating to enhance banking operations, improve security, and provide a truly personalized experience for customers. At BitViraj Technology, we explore how AI-first banks are reshaping the financial landscape and what this means for the future of banking.

Customer-Centric AI Agents

AI-first banks are focused on providing a hyper-personalized experience for their customers, with a range of AI-driven solutions designed to meet individual needs.

- Personalized Banking Assistants: AI agents act as 24/7 virtual assistants, offering tailored financial advice, budgeting guidance, and investment recommendations based on real-time data and customer profiles.

- Natural Language Processing (NLP): AI-driven chatbots, voice assistants, and messaging platforms enable seamless, human-like interactions, helping customers get the information they need quickly and effortlessly.

Fraud Detection and Security

Security is a top priority for AI-first banks, and multi-agentic AI plays a pivotal role in ensuring robust protection.

- Real-Time Monitoring: AI agents work continuously to monitor transactions, quickly identifying any unusual patterns or potential fraudulent activity, and taking immediate action to prevent loss.

- Collaborative Defense Mechanisms: A network of AI agents collaborates to share insights and adapt to emerging security threats, ensuring that the defense mechanisms are always evolving.

Risk Management and Compliance

Managing financial risk and ensuring compliance with ever-changing regulations are key challenges for banks.

- Regulatory Compliance Agents: AI monitors transactions and ensures adherence to financial regulations by generating compliance reports, flagging potential violations, and assisting in audit processes.

- Risk Assessment Agents: AI assesses market conditions, evaluates credit risks, and analyzes portfolio performance, providing data-driven insights for risk management strategies.

Loan and Credit Evaluation

AI-first banks are changing the way loans and credit are evaluated, making the process faster, fairer, and more accurate.

- AI-Powered Credit Scoring: By using alternative data sources—such as social media activity and transaction history—AI can assess creditworthiness with greater precision, reducing reliance on traditional credit scoring methods.

- Dynamic Loan Pricing: AI can assess a customer's credit risk in real-time, adjusting loan pricing, interest rates, and terms based on market conditions and individual profiles.

Investment and Wealth Management

AI is revolutionizing wealth management by offering intelligent, data-driven investment solutions.

- AI-Driven Robo-Advisors: AI can autonomously manage investment portfolios, automatically rebalancing assets based on market trends and risk tolerance, ensuring that investments are optimized for the best returns.

- Predictive Analytics: AI forecasts market trends and analyses historical data to provide proactive investment strategies tailored to each customer's financial goals.

Operational Efficiency and Process Automation

AI-first banks streamline operations, cutting down on manual tasks and boosting efficiency.

- Process Automation Agents: AI-powered agents handle routine tasks such as document processing, account reconciliation, and customer onboarding, enabling banks to operate more efficiently.

- Resource Optimization: AI analyzes data to optimize staffing levels, branch operations, and IT infrastructure, ensuring that resources are allocated where they are needed most.

Multi-Agent Collaboration

Multi-agent systems allow AI agents to collaborate and solve complex financial challenges, such as liquidity management and customer financial health optimization.

- Decentralized Decision-Making: AI agents work together to make data-driven decisions on complex issues, ensuring that each agent contributes its expertise to find the best solution.

- Continuous Learning and Adaptation: AI agents continually improve their decision-making processes through machine learning and reinforcement learning, allowing them to adapt to changing conditions and enhance their accuracy over time.

Benefits of AI-based Banks with Multi-Agentic AI

The integration of AI and multi-agent systems into banking operations offers several distinct benefits:

| Benefit | Explanation |

|---|---|

| Hyper-Personalization | Customers enjoy tailored financial products and services, improving engagement and satisfaction. |

| Enhanced Security | Real-time fraud detection and adaptive threat responses help minimize security risks and protect customer assets. |

| Cost Efficiency | AI-driven process automation reduces operational costs by streamlining tasks and optimizing resource allocation. |

| Scalability | AI systems can manage growing transaction volumes and customer bases with ease, scaling up without compromising service. |

| Proactive Insights | AI uses predictive analytics to deliver insights and enable real-time decision-making, leading to better outcomes. |

Challenges to Address

While AI-first banks with multi-agentic AI offer numerous advantages, there are some key challenges that need to be addressed:

- Data Privacy: Ensuring the secure, ethical use of customer data is essential. AI-driven banks must maintain strict privacy standards to build trust with customers and comply with data protection regulations.

- Regulatory Compliance: AI-first banks must navigate complex financial regulations to ensure that their automated decision-making processes comply with local and international laws.

- Explainability and Trust: Customers need to trust AI-based services, which means that AI decisions should be explainable. Banks must ensure transparency in how AI makes decisions, especially when it comes to things like loan approvals and risk assessments.

- Seamless Integration: For AI to be fully effective, multi-agent AI systems must integrate smoothly with existing banking infrastructure. This can require significant investments in technology and change management to ensure operational continuity.

The Future Outlook

AI-first banks powered by multi-agentic AI are set to revolutionize the financial industry. These banks are not just adopting AI as a tool, but creating an entirely new approach to banking, where AI serves as the core driving force.

- Democratizing Financial Access: AI will make banking more inclusive, offering automated financial services that cater to underserved or unbanked populations.

- Real-Time Decision Making: AI will enable data-driven decisions on a larger scale, helping banks to respond to market fluctuations, customer needs, and regulatory changes in real-time.

- Fully Autonomous Banking Ecosystem: AI could minimize human intervention in everyday banking operations, leading to fully autonomous systems that still prioritize transparency, compliance, and customer trust.

Conclusion

At BitViraj Technology, we are at the forefront of AI innovation, driving the future of banking. As AI technology continues to evolve, we are committed to creating smarter, more efficient, and customer-centric financial solutions for the digital age.

Contact BitViraj Technology today to learn more about how AI-first banks with multi-agentic AI can revolutionize your financial operations!

Case Studies

Empowering Digital

Evolution

Blogs

Empowering Digital

Evolution

BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

Embark on a DigitalJourney

The next-generation digital technology company Bitviraj has the potential to empower and reinvent business in the current fast-paced market.

Our Service

- Website Development

- Application Development

- Blockchain Development

- Gaming and Metaverse